Recently, the industry data released by International Data Corporation (IDC) for the first half of 2025 painted a vivid picture of the global smart glasses market's development. The data revealed that global smart glasses shipments reached 4.065 million units, marking a substantial year-over-year increase of 64.2%. This robust growth trajectory underscores the industry's immense potential. Chinese smart glasses manufacturers delivered particularly impressive performance, with shipments surpassing 1 million units. Their year-over-year growth rate matched the global average, securing a firm foothold with a 26.6% share of the global market. While international brands retain their traditional advantages in the consumer market, Chinese manufacturers have successfully carved out a significant position in the global competitive landscape through targeted marketing investments and diversified channel expansion strategies, demonstrating robust market competitiveness.

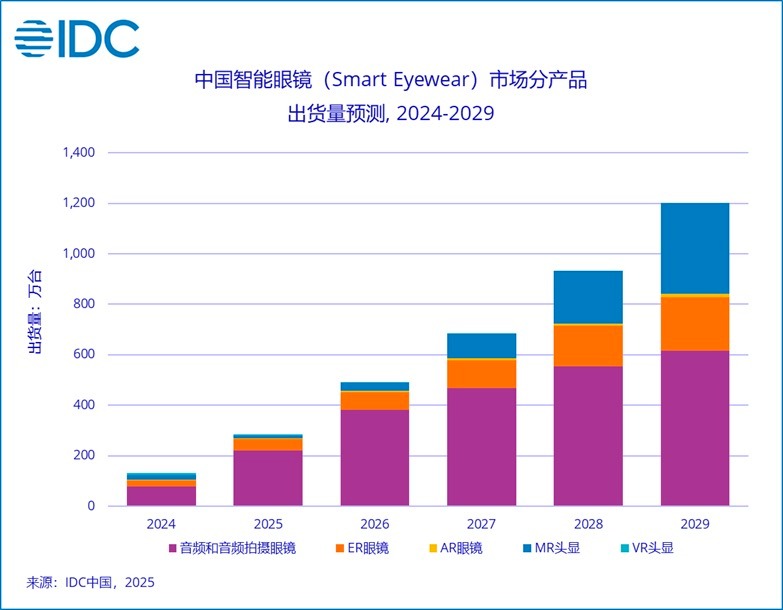

Chinese smart glasses manufacturers are accelerating their global expansion by leveraging their full industrial chain advantages—from optical modules and sensors to complete device assembly—while deepening their presence in key overseas markets, thereby continuously enhancing their global influence. IDC forecasts that global smart glasses shipments will exceed 40 million units by 2029, with China's compound annual growth rate (CAGR) reaching 55.6% from 2024 to 2029, positioning it to become the core engine of global growth.

The market segments exhibit a differentiated landscape: Audio and audio-recording glasses, ER glasses (dominating over 97% of China's binocular full-color segment), and AR glasses (holding 57.3% of China's market share) are the primary growth drivers, with China leading across multiple categories. MR headsets saw declining shipments due to product refresh cycles and lack of blockbuster models. The VR headset market exhibits significant regional disparities, with China's B2B segment accounting for over 50% of the market and serving as a pillar.

The industry's development is driven by AI empowerment, supply chain optimization, breakthroughs in optical technology, and the entry of major players. Product designs continue to evolve toward lightweight and intelligent forms, with applications spanning both consumer and industrial sectors. Looking ahead, smart glasses are poised to become the next-generation core of human-machine interaction. Leveraging their comprehensive strengths, Chinese manufacturers are expected to lead the global market and propel the industry toward large-scale development.